In order to prevent missing trader fraud, a new legislation has been formulated which will affect the construction industries. This step has been taken, to counter criminal attacks on the VAT system and is called the VAT domestic reverse charge for the construction sector aka DRC.

Owing to this, if you are in the construction business you will have to manage and pay VAT differently than you were before. It is eminent you fully understand this legislation and how it impacts your business, in order for you to fulfil this compulsory requirement by HMRC. Keep reading below to find out how the DRC will affect your businesses finances.

Which businesses are affected by the domestic reverse charge?

DRC will affect around 150,000 businesses and many businesses are still not aware of it, which will create several issues later. Some businesses that will be affected are construction, demolition, repair, remodelling, restoration, tunnelling, boring, landscaping, lighting, civil engineering, heating, water supply, drainage, roadworks, reservoirs, fire proofing, and air conditioning.

Why was the domestic reverse charge introduced?

After the success of similar reverse charge schemes in other sectors, it is being introduced to the construction industry. This is because the application foils sophisticated fraudulent schemes made on the industry. Thus, these measures have been taken by HMRC to ward off all types of fraud and preventing businesses from vanishing without paying their VAT bill.

The changes will come into effect from the 1st of March 2021. Initially this legislation was to be implemented in 2019, then was postponed till 2020. Then of course, with many things, it was held back due to coronavirus and its debilitating effect on the industry.

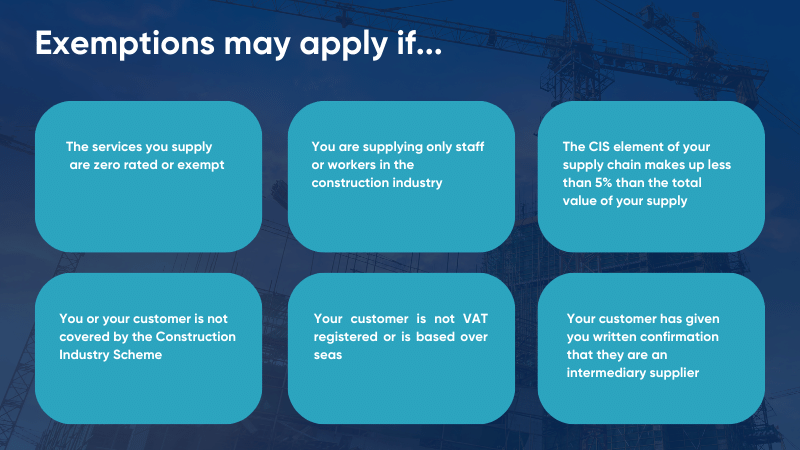

Who is exempt from the domestic reverse charge?

There are certain exemptions to this. Firstly, it is not applicable on any foreign projects that you undertake. It is applied only on all local services your construction company provides within the UK. Additionally, it will not be applied if you were dealing with domestic clients. So any work done for non-VAT registered individuals like home owners you will do the invoicing through the standard procedure.

What has changed?

-

VAT registered subcontractor (supplier) will now not have to account for VAT, if the services are being provided to a VAT registered contractor (customer).

-

VAT registered contractor (customer) will now have to report for input as well as output tax on all bills received from VAT registered sub-contractors.